Google ruled a monopoly; search industry braces for change

In a landmark ruling, a federal judge has declared Google a monopoly, citing the tech giant’s anticompetitive practices in maintaining its dominant position in the search engine market. This decision could have significant impacts on the search industry and digital marketing writ large, potentially reshaping the landscape for SEO strategies and paid search. As Google appeals the ruling, the entire digital ecosystem braces for changes that could introduce more competition, lower advertising costs, and increase transparency in search engine marketing.

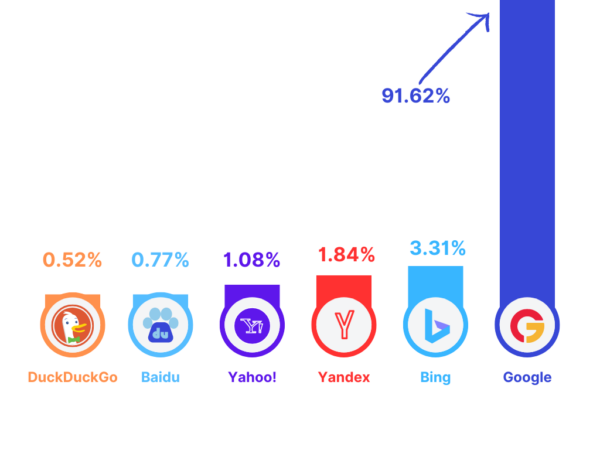

On Monday, a federal judge ruled that Google has unlawfully maintained a monopoly in the search engine market, marking a significant victory for the U.S. Justice Department and the 35 states that brought the case against the tech giant. The court found that Google’s business practices, such as paying billions to ensure it remains the default search engine on devices like Apple and Samsung products, were designed to stifle competition and maintain its dominant position — the definition of a monopoly.

Legal implications and precedents

Google immediately said it will appeal the decision. The appeals process could extend the timeline of the resolution of this case, potentially delaying any immediate changes to Google’s business practices. It’s worth noting that there was a relatively recent monopoly ruling against the NFL, which was overturned on appeal in just over a month. This suggests that while the initial ruling is a Big DealTM, the odds that Google will successfully overturn this decision on appeal are non-zero. Exactly how non-zero are their odds? At the risk of sounding like an SEO: it depends. These types of cases are notoriously complex. The vagaries of U.S. antitrust laws are fairly open to broad interpretation, and Google, of course, has the very best lawyers their vast mountains of money can buy. It should be noted that the NFL case was very different from the Google case and in my “I’m not a lawyer, but I did stay at a Holiday Inn Express” opinion, the cases are not analogous.

Comparisons to past antitrust cases

More so than the NFL antitrust case, the Google suit reminds me of the early 1980s antitrust suit against AT&T which resulted in the company being broken up into dozens of smaller pieces, but that was a very long time ago and the tech landscape is totally different now. Probably the most analogous antitrust suit is the 1998 case against Microsoft in which Microsoft was found to be holding “an oppressive thumb on the scale of competitive fortune.” Notably, Microsoft was not broken up into smaller pieces like AT&T, and the Microsoft case was the model the DOJ used for the Google suit. Originally, Microsoft was supposed to be divided into two halves, one for the operating system and another for the software products, but ultimately they settled with the DOJ and agreed to conduct modifications while remaining intact as a business unit. In both cases, AT&T and Microsoft survived but neither really held or reached the same level of dominance (which, I suppose, was the point). In Microsoft’s case, they were essentially hamstrung while companies like Google and Facebook basically ran roughshod over, well, everyone. It will be interesting to see what the remedy/punishment is for Google. Will it be the AT&T treatment or the Microsoft treatment? Either way, it won’t be the same business it was last week.

Implications for the US market

If the decision is upheld on appeal, it could lead to a more competitive search engine market in the US. Consumers might see more choices for default search engines on their devices, and smaller competitors could have a better chance to innovate and gain market share. This could also result in stricter regulations and oversight of large tech companies, potentially setting a precedent for future antitrust cases in the technology sector.

Implications for the EU market

In the EU, regulators have already taken a hard stance against Google’s market practices, resulting in several fines and imposed changes. This US decision could bolster the EU’s regulatory framework and encourage similar legal actions or stricter enforcement of existing rules. It may also inspire new regulations aimed at curbing the power of dominant tech companies, further promoting competition and consumer choice in the digital marketplace.

Impact on SEO and digital marketing

The ruling against Google could significantly affect the SEO and digital marketing landscape. If Google is forced to alter its business practices, it could open up the market for other search engines, leading to a more diversified search environment. (Diversification is the goal of the ruling.) This diversification could impact SEO strategies, as businesses would need to optimize for multiple search engines rather than solely primarily focusing on Google. Reporting will change, strategies will change, how resources and time are allocated will need to change. It will be a significant disturbance in the force.

One side effect, perhaps unintended, might be that the “rules” of SEO that we play by right now will become somewhat unenforceable because they were created by Google to close exploitable loopholes in the algorithm and other search engines might not have the same objections to them. Rules like “you can’t sell links” and the prohibition of “reputation parasite SEO” were added to modify publisher behaviors that skewed or manipulated the SERPs. We could be looking at a return, or maybe a partial return, to the halcyon days of link buying and selling, overt pay-to-play publishing, and high authority subdomain rentals.

Search Engine Marketing (SEM) and paid ads

For SEM and paid ads, the decision could lead to changes in Google’s advertising model. If Google is required to reduce its control over the search market, there might be more opportunities for advertisers to explore alternative platforms. This could potentially lower the cost-per-click (CPC) on Google Ads due to increased competition and provide more options for advertisers looking to diversify their ad spend across different platforms.

Advertisers may also benefit from improved ad transparency and fairer bidding processes, as regulatory scrutiny could enforce stricter guidelines on how ads are served and priced. The overall effect could be a more competitive and equitable digital advertising ecosystem, benefiting both advertisers and consumers.

However, lower paid search costs for advertisers will translate to lower revenues for publishers whose business model revolves around revenue from CPM, PPC and PPA ads or affiliate relationships. A reduction in ad prices would translate to less revenue, potentially impacting their ability to produce content, maintain staff, and invest in new technologies. This shift could drive publishers to seek alternative monetization strategies, such as subscription models, sponsored content, or diversified advertising partnerships.

Final thoughts

Ultimately, if this decision is not overturned on appeal, the digital marketing ecosystem should expect a major shift in dynamics, where both new opportunities and new challenges will emerge as a result of increased competition and regulatory changes.

How do you foresee the potential diversification of search engines affecting the SEO Plugin strategies, specifically for e-commerce websites when it comes to cater structured data (schema)? In near future, do you guys plan on giving us search engine specific settings and schema preferences ? Like right now if i use detailed itemlist schema on category page, I see failed status on google rich snippet test. But it gets passed on validatory.schema.

I’m actually worried about my ecom store (Shoppingjin) on which i started getting orders from Bing this year. Reason of which is quite clear from your article.

I am actually using yoast for schema generation on my website and i am loving orders from bing and i just don’t want to see my self picking just one search engine specific setting in the future for my website and face errors on other search engine.

I’m not aware of a situation where one set of schema is good for one search engine, and a different set of schema is not only required for the second search engine, but also the first set of schema is actively BAD for the second search engine — it is more like some search engines might prefer certain types of schema over others, but there is no situation where a search engine will look at your schema and say “oh, you’ve also optimized for Google so I shall just ignore you completely, you traitor!” I do not foresee a future where schema elements are recommended for specific engines, so a feature where you can pick and choose which schema to include or not include on a per engine basis is probably never going to be on the Yoast roadmap.

Now, for the schema on your category page that isn’t showing up on the Google Rich Snippet test — as far as I’m aware (per the Google documentation here: https://developers.google.com/search/docs/appearance/structured-data/search-gallery) the Rich Snippet Test does not test for all (or even most) of the schema elements that are available. It’s only going to test for the things that Google Search supports. This doesn’t mean you should strip out the schema from your page, it just means Google Search isn’t using that element right now and therefore isn’t testing for it. Other search engines might use it, and it’s not hurting anything to have it on the page. Also, things change — Google could decide to use it tomorrow, and if they do, you’re already prepared!