Sales tax/VAT handling by Yoast.com

VAT stands for Value-Added Tax, also known as sales tax in the USA. Different countries apply different VAT or sales tax values. We calculate the VAT/sales tax automatically based on the address you enter when you purchase a product on yoast.com.

Sales tax in the USA

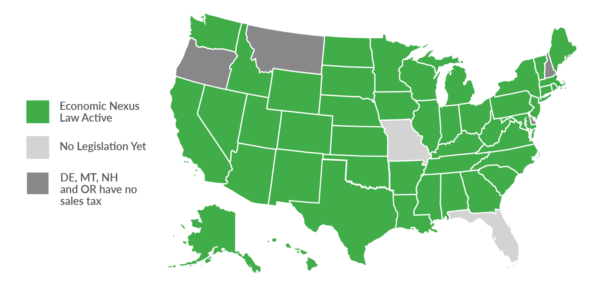

Economic Nexus Laws

With the implementation of the economic nexus in 2018 in the US for sales tax, businesses outside the US become tax liable after reaching a certain threshold of sales. As of January 2021, Yoast may have reached this threshold in your state. If that’s the case, we’re therefore obliged to collect sales tax, resulting in a slight increase in the price of our products. You can read more information on sales tax and sales tax nexus.

VAT in the EU

We’re obligated to charge VAT for everyone who lives or has their company in the EU. The VAT is automatically calculated based on the country you select during checkout. There, you can also select whether you’re a person or a company. When selecting company you’ll be able to enter a VAT number, displayed on the invoice you’ll receive. If you enter a valid VAT number, VAT won’t be charged.

There’s one exception to this rule: If you’re from The Netherlands, you’ll always have to pay VAT (BTW) since the company Yoast is based in The Netherlands.

VAT in the UK

As of January 1st, 2021, if you’re located in the UK, you are required to pay UK VAT on all purchases made on yoast.com, even though we are based outside the UK, per UK government regulations. At this moment, you cannot apply for tax exemption on yoast.com if you’re located in the UK, as the HMRC provides no way for us to validate your business records.

Sales tax/VAT in other countries

If you’re located in a country outside of the USA, UK or EU, you won’t have to pay VAT when buying our products.

Is your organization tax exempt?

If your organization is exempt from sales tax, please follow the instructions here to get tax exempt status, so that we can update your account accordingly.

Why is my VAT number rejected?

We validate your VAT number in the checkout. If it’s rejected, you can read about the most common reasons for that here.

Did this article answer your question?

Still having issues?

Try searching for your issue below