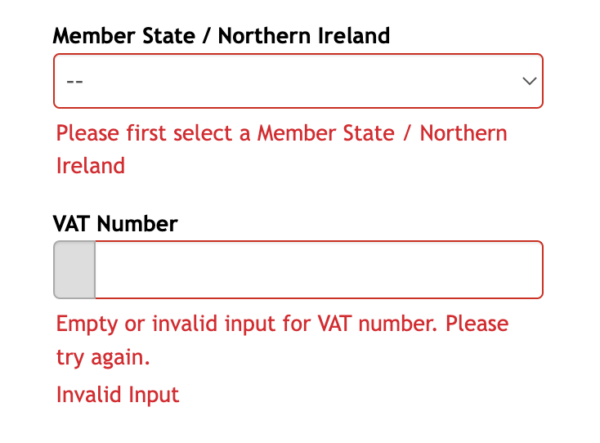

Why is my VAT number rejected?

In our checkout process, we immediately validate your VAT number. To do so, we use the VIES VAT number validation API.

Your VAT number may be rejected for a number of reasons but here are the most common ones:

- Your VAT number is invalid.

- The VIES API is down or slow.

- Our checkout isn’t working correctly.

How to check if your VAT number is valid

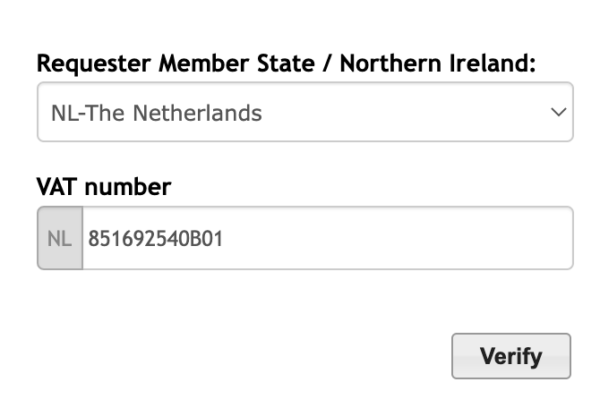

- Go to https://ec.europa.eu/taxation_customs/vies/#/vat-validation.

- Enter your country and VAT number in the top section.

- Enter our details in the bottom section.

Requester Member State: NL – The Netherlands

Yoast VAT number: 851692540B01

- Click ‘Verify’.

If you receive a message that your VAT number is invalid, VIES recommends that you contact your tax administrator for assistance.

If you receive a message that VIES is not working, please try again later.

If you receive a different message, please see this VIES help document to determine the next step.

My VAT number shows as valid in VIES

If you receive a message using the steps above that your VAT number is valid, please clear your browser cache and cookies before placing the order again. In some cases, you may have success with another browser or computer.

If you continue to have trouble with the checkout process, please contact our support team.